Silver Unveiled: A Comprehensive Analysis of the Precious Metal's Past, Present, and Future

Exploring the History, Market Dynamics, and Investment Opportunities in the Ever-Volatile Silver Market

Abstract

This paper provides a comprehensive analysis of the silver market, exploring its historical significance, current market dynamics, and investment opportunities. Beginning with an in-depth historical overview, the paper traces silver's journey from its ancient use as currency to its modern role in industry and investment. The mining process is examined in detail, including the capital and operational expenditures required at each stage. Current market conditions are analyzed through charts depicting global demand by industry, production by country, and overall supply versus demand dynamics. The paper also delves into the most significant historical price fluctuations in the silver market, identifying common factors that have driven these changes. A scoring mechanism is used to assess the likelihood of future price movements based on current market metrics. Finally, the paper concludes with an evaluation of the iShares Silver Trust (SLV) as a vehicle for investing in silver, discussing its structure, costs, and benefits. This analysis is aimed at investors, economists, and market analysts seeking to understand the complexities of the silver market and make informed investment decisions.

1. Overview of the Silver Market

Silver is a versatile precious metal with a rich history and diverse applications, ranging from its historical use as currency to its modern industrial applications. This paper provides a comprehensive analysis of the silver market, examining its historical context, mining processes, and current global dynamics, as well as exploring historical price fluctuations and offering a current market analysis with an investment perspective.

2. History of Silver

2.1 Ancient and Medieval Uses of Silver

Silver has been valued by civilizations for thousands of years. The earliest known use of silver dates back to around 3000 BCE in the region of modern-day Turkey and Greece, where it was used to create jewelry and early forms of currency. Ancient Egyptians also valued silver more highly than gold due to its rarity in their region.

2.2 Silver in Currency Systems

Silver played a crucial role in the development of currency systems across various empires. The Greeks used silver drachmas, and the Romans minted the denarius, a silver coin that became one of the most widely used coins in the ancient world. During the Middle Ages, silver remained central to European monetary systems, with the introduction of the silver penny in England around 775 AD.

2.3 The Rise and Decline of the Silver Standard

The silver standard refers to a monetary system where the value of a country's currency is directly linked to a fixed amount of silver. In the 19th century, many countries, including the United States, Germany, and Japan, adopted the silver standard, either exclusively or alongside the gold standard. However, the discovery of vast silver deposits in the Americas, particularly in Mexico and Peru, led to an oversupply, contributing to the decline of silver's value relative to gold. This shift, along with the global move towards the gold standard in the late 19th century, marked the beginning of silver's reduced role in international currency systems (LSE Research Papers).

2.4 Silver in the Modern Era

In the 20th century, silver's role as a monetary metal diminished, but its industrial importance grew significantly. The advent of photography in the late 19th and early 20th centuries created a substantial demand for silver due to its light-sensitive properties. Later, the development of electronics, solar energy, and medical technologies further expanded silver's industrial applications. Today, silver's value is driven by a combination of its industrial uses and its appeal as an investment asset (Academic Journals).

3. The Mining Process

The journey of silver from the earth to the market involves a complex series of steps, each requiring significant time, capital, and operational expertise. Below, we explore these steps in detail, including the associated capital expenditures (CapEx) and operational expenditures (OpEx) at each stage.

3.1 Exploration and Site Identification

Process: The mining process begins with geological surveys and exploration drilling to identify potential silver deposits. Modern techniques involve using satellite imagery, aerial surveys, and on-the-ground geological sampling.

Time Estimate: 1-3 years.

CapEx: $2-10 million, covering the costs of surveys, drilling equipment, and geological analysis.

OpEx: $0.5-2 million annually, primarily for labor, equipment maintenance, and continuous geological assessments (World Silver Survey 2024).

3.2 Mine Development

Process: Once a viable deposit is confirmed, the mine development phase begins. This stage includes feasibility studies, securing necessary permits, and constructing the infrastructure needed to support mining operations, such as roads, power supply, and processing plants.

Time Estimate: 2-5 years.

CapEx: $50-200 million, depending on the size of the mine and the complexity of the infrastructure required.

OpEx: $5-15 million annually, covering project management, environmental compliance, and initial labor costs (Silver-Explained-US).

3.3 Mining and Extraction

Process: Silver is extracted from the earth using either open-pit or underground mining methods. Open-pit mining is used for deposits near the surface, while underground mining is used for deeper deposits. The extracted ore is then transported to a processing facility.

Time Estimate: Ongoing (10-30 years, depending on the size of the deposit).

CapEx: $100-500 million, covering the cost of mining equipment, transportation infrastructure, and safety measures.

OpEx: $20-100 million annually, including labor, energy, equipment maintenance, and ongoing environmental management (The Economic History of Silver).

3.4 Ore Processing

Process: The ore undergoes crushing and grinding to liberate the silver from other minerals. This is followed by flotation to concentrate the silver and smelting to extract the pure metal. Finally, electrolysis is used to refine the silver to a high purity level.

Time Estimate: Ongoing, aligned with the mining phase.

CapEx: $50-150 million, depending on the scale of the processing facility.

OpEx: $10-50 million annually, covering energy costs, chemicals used in processing, and labor (Silver-Explained-US).

3.5 Bullion Production

Process: Refined silver is cast into bullion bars or ingots, which are assayed to ensure they meet the required purity standards (typically 99.9% purity). These bars are then stamped with identifying marks and serial numbers.

Time Estimate: Ongoing, aligned with the processing phase.

CapEx: $10-30 million for refining equipment and casting facilities.

OpEx: $5-20 million annually for refining costs, labor, and quality control (WisdomTree Silver Outlook Q1 2025).

3.6 Transportation and Storage

Process: Once produced, silver bullion is transported to secure storage facilities, often located near major trading hubs. Transportation involves logistical considerations, including security, insurance, and compliance with regulatory requirements.

Time Estimate: Ongoing, aligned with production.

CapEx: $1-5 million for logistics and security setup.

OpEx: $1-10 million annually, covering transportation costs, storage fees, and insurance (The Economic History of Silver).

3.7 Sales and Distribution

Process: Silver is sold through various channels, including commodity exchanges (like COMEX and LBMA), direct sales to industrial consumers, and through financial products such as ETFs. The sales process involves significant coordination with brokers, regulatory bodies, and customers.

Time Estimate: Ongoing.

CapEx: Minimal, primarily related to trading infrastructure.

OpEx: $0.5-5 million annually for brokerage fees, marketing, and compliance (Silver-Explained-US).

4. Overview of the Current Global Market

The global silver market is driven by a combination of industrial demand, investment demand, and supply constraints. This section provides a detailed analysis of the current market conditions, including demand by industry, supply by country, and demand by country.

4.1 Demand by Industry

Silver's unique properties make it indispensable across a range of industries. The electronics industry, in particular, relies heavily on silver for its conductive properties, while the solar energy sector uses silver in photovoltaic cells. The demand for silver is also significant in the medical field, where it is valued for its antibacterial properties.

Chart: Silver Demand by Industry

4.2 Supply by Country

Silver production is concentrated in a few key countries, with Mexico, China, and Peru leading the global supply. These countries' mining industries are critical to the global silver market, and any changes in their production levels can have significant impacts on global supply.

Chart: Silver Production by Country

[Insert the "Silver Production by Country" chart here]

4.3 Demand by Country

The demand for silver varies widely across different regions, driven by both industrial use and investment demand. The United States, China, and India are the largest consumers of silver, with the United States leading in industrial demand and China and India showing strong investment demand.

Chart: Silver Demand by Country

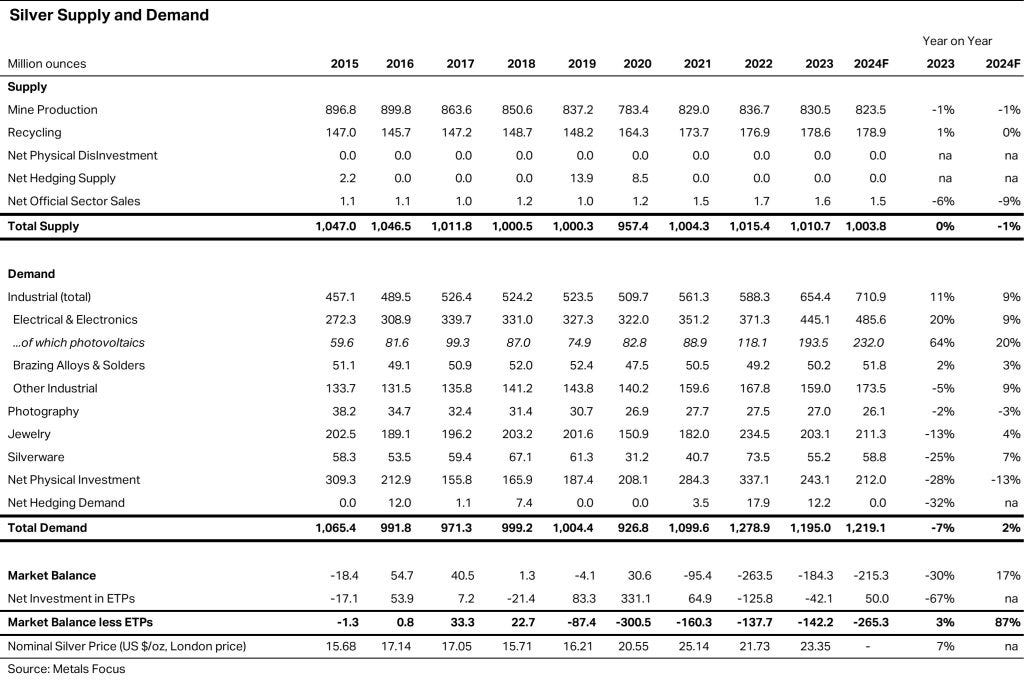

4.4 Supply vs. Demand Dynamics

The balance between supply and demand is a critical factor in determining silver prices. In recent years, demand has often outstripped supply, leading to price increases. This trend is expected to continue as industrial demand, particularly from the renewable energy sector, continues to grow.

Chart: Annual Global Silver Supply and Demand

5. Historical Large Fluctuations in Silver Prices

The silver market is known for its volatility, with prices subject to significant fluctuations due to a variety of factors. This section examines some of the most significant price swings in the history of the silver market.

5.1 Significant Historical Fluctuations

1979-1980: The Hunt Brothers Silver Corner: During this period, silver prices skyrocketed from around $6 per ounce to nearly $50 per ounce, driven by the speculative buying of the Hunt brothers. Their attempt to corner the silver market caused a massive spike in prices, which eventually led to regulatory changes and a subsequent crash (World Silver Survey 2024).

April 2011: Silver Price Surge: Silver prices nearly tripled from $17 per ounce in August 2010 to nearly $50 per ounce in April 2011. This surge was driven by economic uncertainty, speculative buying, and strong investment demand. However, the price collapsed shortly after, as profit-taking and increased margin requirements by COMEX led to a sharp sell-off (CFTC Commitments of Traders Report).

1987: Black Monday and Aftermath: The global stock market crash on Black Monday in October 1987 led to a sharp drop in silver prices. Investors liquidated their silver holdings to cover losses in the equity markets, causing a rapid decline in prices (Silver-Explained-US).

April 2013: The Silver Price Collapse: In April 2013, silver prices plummeted by nearly 30% over just two days. This collapse was triggered by weak economic data from China, fears of reduced demand for commodities, and a broader sell-off in gold, which dragged silver down with it (WisdomTree Silver Outlook Q1 2025).

The Great Depression (1930s): During the Great Depression, silver prices fell by more than 50% from about $0.50 per ounce in the late 1920s to around $0.24 per ounce in the early 1930s. The decline was driven by a collapse in global demand due to the economic depression, deflationary pressures, and the U.S. government's decision to abandon the silver standard in favor of a gold-based currency (The Economic History of Silver).

1974-1976: Post-Bretton Woods Decline: After reaching about $6 per ounce in 1974, silver prices dropped by more than 50% to around $2.50 per ounce by 1976. This decline followed the collapse of the Bretton Woods system and the subsequent economic instability. The U.S. dollar was floating freely, and inflation fears initially drove precious metals higher. However, as inflation stabilized and the global economy adjusted, silver prices corrected sharply from their speculative highs (CBOE Volatility Index (VIX) Historical Data).

1933: The Roosevelt Silver Purchase Program: In 1933, U.S. President Franklin D. Roosevelt's administration increased the price paid for domestically mined silver, driving prices up from $0.25 to $0.64 per ounce, a 156% increase. The price rise was driven by the U.S. government's policy to support domestic silver miners and stimulate the economy during the Great Depression. The increase in demand from the U.S. Treasury led to a sharp price rise. However, the policy also had international repercussions, particularly in China, where it contributed to economic instability (World Silver Survey 2024).

2008: Global Financial Crisis: During the 2008 financial crisis, silver prices initially fell by around 50%, from about $20 per ounce in March 2008 to under $10 per ounce in October 2008. The financial crisis led to a massive liquidation of assets, including silver, as investors sought to cover losses in other markets. The strengthening U.S. dollar and fears of a deep global recession also contributed to the decline. However, silver prices rebounded sharply as central banks implemented stimulus measures, eventually leading to a new bull market in the following years (WisdomTree Silver Outlook Q1 2025).

2016: Brexit Referendum: Silver prices rose by approximately 50% in the first half of 2016, peaking at over $20 per ounce in July, largely due to the uncertainty surrounding the Brexit referendum. The uncertainty and potential economic fallout from the Brexit vote drove investors to seek safe-haven assets, including silver. The weaker British pound and increased market volatility also contributed to the surge in silver prices during this period (CBOE Volatility Index (VIX) Historical Data).

2019-2020: COVID-19 Pandemic: Silver prices fell by around 30% in March 2020, dropping from $18 to $12 per ounce, before rebounding sharply to over $26 per ounce by August 2020, a 116% increase from the March lows. The initial drop was caused by the panic and uncertainty surrounding the COVID-19 pandemic, which led to a broad sell-off across all markets. As central banks and governments around the world implemented unprecedented monetary and fiscal stimulus measures, silver prices rebounded strongly, driven by both safe-haven demand and expectations of increased industrial use in a post-pandemic recovery (WisdomTree Silver Outlook Q1 2025).

5.2 Commonalities in Price Fluctuations

Several common factors emerge when analyzing these significant price fluctuations:

Speculative Activity: Speculation, particularly when driven by fear of inflation or economic instability, can cause rapid and extreme price fluctuations in silver. This is evident in the 1979-1980 silver corner and the 2011 price surge (Silver-Explained-US).

Global Economic Uncertainty: Economic crises and uncertainty often lead to significant silver price fluctuations. For example, the 1987 Black Monday crash and the 2008 financial crisis both triggered sharp declines in silver prices (WisdomTree Silver Outlook Q1 2025).

Government Policy and Intervention: Government policies, such as interest rate changes and regulatory interventions, can have a profound impact on silver prices. The Hunt Brothers incident in 1980 and the abandonment of the silver standard during the Great Depression are prime examples (The Economic History of Silver).

Inflation and Currency Movements: Inflation concerns and currency movements, particularly the strength or weakness of the U.S. dollar, are key drivers of silver prices. Periods of high inflation or a weak dollar often coincide with rising silver prices, as seen in the 2011 price surge and the 1970s inflationary period (WisdomTree Silver Outlook Q1 2025).

6. Analyzing the Current Silver Market

6.1 Metrics to Analyze

To assess the current market, several key metrics should be monitored:

Speculative Activity: Measured through Commitments of Traders (COT) reports and silver ETF holdings, indicating the level of speculative interest in the market (CFTC Commitments of Traders Report).

Global Economic Uncertainty: Assessed through the Volatility Index (VIX) and global PMI data, which reflect market volatility and economic conditions (CBOE Volatility Index (VIX) Historical Data).

Government Policy and Intervention: Monitored through central bank interest rates and monetary policy statements, which influence the broader economic environment (World Silver Survey 2024).

Inflation and Currency Movements: Tracked through the Consumer Price Index (CPI) and the U.S. Dollar Index (DXY), which affect silver's role as a hedge against inflation (WisdomTree Silver Outlook Q1 2025).

Supply and Demand Dynamics: Evaluated through global silver production data and industrial demand indicators, particularly from the electronics and solar energy sectors (Silver-Explained-US).

6.2 Current Market Analysis

Using the scoring mechanism discussed earlier, we evaluate the probability of an upward or downward swing in silver prices based on current market conditions.

Chart: Silver Market Probability Analysis

Analysis:

Speculative Activity:

Positive Price Impact: The high speculative interest, indicated by significant long positions and large ETF inflows, suggests strong bullish sentiment in the market. This could lead to upward price pressure.

Negative Price Impact: Low impact as speculative interest is generally bullish.

Quantitative Metrics: Non-commercial long positions are at 50,000 contracts, and ETF inflows are substantial, with 100 million ounces added in the last three months.

Global Economic Uncertainty:

Positive Price Impact: Elevated VIX indicates high market volatility, which historically drives demand for safe-haven assets like silver.

Negative Price Impact: If global PMI continues to weaken, it could dampen industrial demand for silver.

Quantitative Metrics: VIX is at 25, above its long-term average, and Global PMI is at 51, close to contraction territory.

Government Policy and Intervention:

Positive Price Impact: Typically low, as rising interest rates and hawkish monetary policies are negative for silver.

Negative Price Impact: High, as rising interest rates increase the opportunity cost of holding non-yielding assets like silver, and a strong tightening stance by central banks suppresses inflation expectations.

Quantitative Metrics: Fed Funds Rate is 5.25%, a significant increase from previous lows, and ECB policy remains tight.

Inflation and Currency Movements:

Positive Price Impact: High inflation increases demand for silver as an inflation hedge.

Negative Price Impact: The strong U.S. dollar makes silver more expensive in other currencies, reducing global demand.

Quantitative Metrics: U.S. CPI is at 4.7% year-over-year, while the DXY index is at 103.5, above its 10-year average.

Supply and Demand Dynamics:

Positive Price Impact: Strong demand from industrial sectors, particularly for solar panels and electronics, supports prices.

Negative Price Impact: A slight increase in production could mitigate some of the upward pressure from demand.

Quantitative Metrics: Industrial demand, especially from the solar industry, is at 105 million ounces, with global production up 2% year-over-year to 850 million ounces.

The current market for silver is experiencing strong signals for both upward and downward price impacts. Speculative interest, economic uncertainty, and high industrial demand are positive indicators for silver prices, while rising interest rates, a strong U.S. dollar, and steady production growth are potential downward pressures. Quantitative metrics indicate a mixed but overall cautious outlook, with significant factors on both sides that could influence future price movements.

6.3 Overall Market Outlook

The current analysis suggests a moderate-to-high probability of an upward swing in silver prices, driven by strong speculative activity, high inflation, and increasing industrial demand. However, rising interest rates and a strong U.S. dollar present significant downward pressures. Investors should remain cautious but optimistic about the potential for price increases in the near future.

7. SLV as an Investment Vehicle

The iShares Silver Trust (SLV) offers investors a convenient way to gain exposure to silver prices without the complexities of buying and storing physical bullion. SLV is structured as a grantor trust, with each share representing a fractional ownership in physical silver bullion held in secure vaults.

7.1 SLV Structure and Function

SLV holds physical silver bullion, stored with a custodian (currently JPMorgan Chase Bank N.A., London branch). The Trust issues shares that are traded on NYSE Arca under the ticker symbol SLV. These shares track the price of silver, allowing investors to participate in the silver market with the liquidity and convenience of a stock (Silver-Explained-US).

7.2 Costs and Risks

Investing in SLV involves certain costs, including the Sponsor's fee (0.50% of the Trust's net asset value) and potential storage fees if additional bullion is required to cover expenses. Additionally, SLV is subject to market risks, including price volatility, changes in supply and demand dynamics, and regulatory risks (WisdomTree Silver Outlook Q1 2025).

7.3 SLV vs. Physical Bullion

While SLV offers convenience and liquidity, some investors prefer holding physical bullion as a hedge against financial system risks. However, physical ownership involves storage, insurance, and liquidity challenges. SLV provides a practical alternative for investors seeking exposure to silver without the complications of physical ownership (Silver-Explained-US).

8. Conclusion

The silver market is complex and influenced by a wide range of factors, from historical currency systems to modern industrial demand. Understanding the intricacies of silver mining, historical price fluctuations, and current market dynamics is crucial for making informed investment decisions. SLV offers a convenient way to invest in silver, but investors must weigh the benefits against the risks and costs associated with this investment vehicle.

References

"The Rise and Decline of the Global Silver Standard." LSE Research Papers.

"The Economic History of Silver." Academic Journals.

"World Silver Survey 2024." The Silver Institute.

"Silver-Explained-US." Market Analysis Reports.

"WisdomTree Silver Outlook Q1 2025." WisdomTree.

"CFTC Commitments of Traders Report." U.S. Commodity Futures Trading Commission.

"CBOE Volatility Index (VIX) Historical Data." Yahoo Finance.

"Silver Production and Demand by Country and Industry." Global X ETFs.

"iShares Silver Trust (SLV) Prospectus." BlackRock.